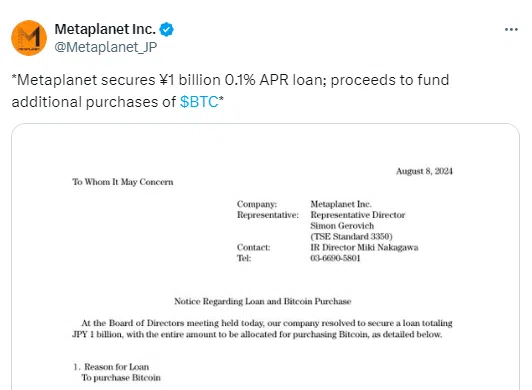

Japanese investment firm Metaplanet announced that it secured a $6.8 million (1 billion Japanese yen) loan from its shareholder, MMXX Ventures. The loan has a 0.1% yearly interest rate and must be repaid in a single payment after six months.

Increasing Bitcoin Holdings

Metaplanet will use this loan to buy 118.5 more Bitcoins at current prices. This news comes shortly after the company announced plans to raise $70 million through a stock rights offering, with $58 million of that amount designated for Bitcoin purchases.

The company’s approach is similar to that of MicroStrategy. Metaplanet aims to use Bitcoin to protect against Japan’s growing debt and the weakening yen. At the Bitcoin 2024 conference in late July, CEO Simon Gerovich discussed this plan. He mentioned that Metaplanet was struggling financially before. The company had trouble managing its finances and paying off debt. Then they decided to invest in Bitcoin, which Gerovich called the “apex monetary asset.” He believes Bitcoin will help the company succeed in the long term.

Financial Effects

So far, Metaplanet has bought 246 Bitcoins worth $13.95 million in seven different purchases. The average price they paid for each Bitcoin is $65,145. Since their first Bitcoin investment on April 23, the value of Bitcoin has dropped by 12.8%. Despite this, the company remains optimistic about Bitcoin’s future.

Since announcing its Bitcoin strategy on April 9, Metaplanet’s stock price has increased by 290%. The stock is now trading at $4.39 (643 Japanese yen). However, this is down from its year-high of $20.50 (3,000 Japanese yen) reached on July 24. The decline was partly due to Bitcoin’s 10% drop on August 5, known as the cryptocurrency industry’s “Black Monday.”

Metaplanet’s decision to boost its Bitcoin holdings shows strong belief in digital assets. More investment firms are starting to use Bitcoin to protect against economic uncertainty. The company’s choice highlights its confidence in Bitcoin’s long-term value. By investing in Bitcoin, Metaplanet aims to strengthen its financial position and secure its future.