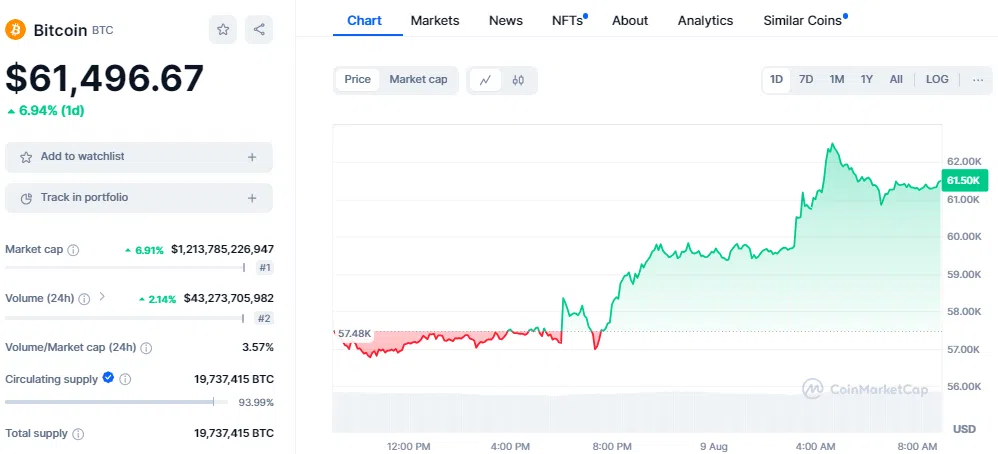

On August 9, Bitcoin climbed back to $62,000, marking a key moment for the cryptocurrency. This rise comes only days after a significant drop during what some called “Crypto Black Monday.” Bitcoin briefly touched $62,510 before settling at $61,496, showing a 14.07% recovery from its low on August 5.

Understanding the Massive Bull Hammer

A trading pattern known as the “Massive Bull Hammer” has emerged on Bitcoin’s chart. This pattern is often seen as a positive sign in trading. It is identified by a long lower wick, which shows that buyers stepped in to push the price higher after a sharp fall. This pattern can indicate that the market has found a bottom and may start to rise.

Crypto trader Matthew Hyland pointed out this pattern, suggesting that Bitcoin may have reached its lowest point. The quick rebound from $58,000 and the strong close above $60,000 have raised hopes among traders that the market could continue to rise.

Reasons Behind Bitcoin’s Rise

Several factors are driving Bitcoin’s recent surge. One major reason is the ongoing interest from large companies. Firms like MicroStrategy and Tesla have been buying more Bitcoin, which is increasing demand. Additionally, Morgan Stanley’s decision to allow its 15,000 advisors to recommend Bitcoin ETFs to clients has boosted confidence in the market.

Another factor contributing to Bitcoin’s rise is concern over inflation and the stability of traditional currencies. With central banks printing more money, many investors are turning to Bitcoin as a safer way to protect their wealth.

However, not all analysts believe that Bitcoin has fully recovered. Markus Thielen from 10x Research suggests that Bitcoin might still drop to the low $40,000s before a new uptrend begins. Similarly, Timothy Peterson from Cane Island believes there is a 50% chance that Bitcoin could either fall to $40,000 or rise to $80,000 within the next two months.

What’s Next for Bitcoin?

The appearance of the “Massive Bull Hammer” suggests that Bitcoin may continue to rise. However, the market remains unpredictable, so traders should be cautious. There is resistance expected at $64,000, with support levels at $58,000 and $60,000. If Bitcoin manages to break through the $64,000 mark, it could move toward $70,000.

On the other hand, if Bitcoin fails to stay above $60,000, it might drop back to lower support levels. The recent drop below $50,000 on August 5 surprised many traders and has made them more cautious.