Bitcoin long-term holders have accumulated a staggering $23 billion in just one month. This significant growth highlights a strong trend among Bitcoin investors. These holders, also known as “permanent holders,” are people who keep their Bitcoin for a long time. They do not sell their Bitcoin quickly. Instead, they hold onto it for many years.

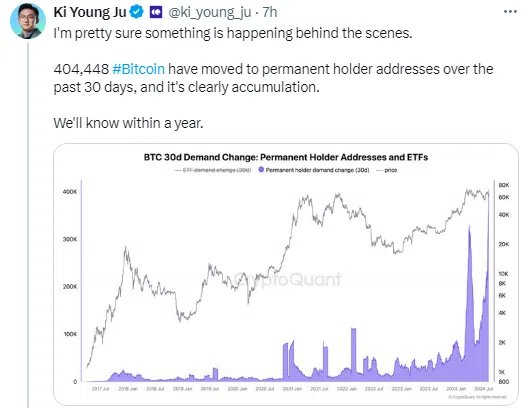

Ki Young Ju posted some important news on X. Data from on-chain sources shows that Bitcoin’s permanent holder addresses have gained nearly $23 billion in BTC over the past month. This sharp rise in Bitcoin demand has drawn a lot of attention.

To explain further, about $22.8 billion, or 404,448 BTC, have recently been transferred to these permanent holder addresses. This big move suggests that major investors are getting more interested in Bitcoin. Ki Young Ju warns that retail investors might regret not buying Bitcoin now. He thinks that big institutions could make major Bitcoin purchases by the third quarter of 2024.

Ki Young Ju also pointed out other encouraging signs for Bitcoin. He noted that miner capitulation where miners sell their Bitcoin due to low prices seems to be ending. Bitcoin’s hash rate, which measures the computing power used for mining and transactions, is approaching record highs. This shows that the Bitcoin network is getting stronger and more secure.

Moreover, the cost of mining Bitcoin in the U.S. is around $43,000 per Bitcoin. This suggests that as long as Bitcoin’s price stays above this level, the market should stay stable. High mining costs can act as a support for Bitcoin’s price, keeping it from falling too much.

Ki Young Ju also observed that retail investors are mostly missing from the market right now. This situation is similar to what happened in mid-2020, when smaller investors showed less interest. He also noticed that the activity of old whales large Bitcoin holders has decreased. Long-term holders who were selling between March and June are not putting much selling pressure on the market now.

Based on these observations, Ki Young Ju thinks the bullish trend in Bitcoin’s market is still strong. However, he mentioned that if the market doesn’t improve in the next two weeks, he might reconsider his view. This could mean that new whales big investors might be making mistakes or not fully grasping the current economic situation.

Ki Young Ju’s observations suggest that Bitcoin’s permanent holders are accumulating a lot of BTC, which could mean big announcements from major institutions are coming. Retail investors should stay alert, as missing this opportunity might lead to regret if major Bitcoin purchases are announced soon.

The recent accumulation of Bitcoin by permanent holders and other positive market signs could signal future growth. Retail investors should keep an eye on these developments as institutional interest and market conditions continue to change.